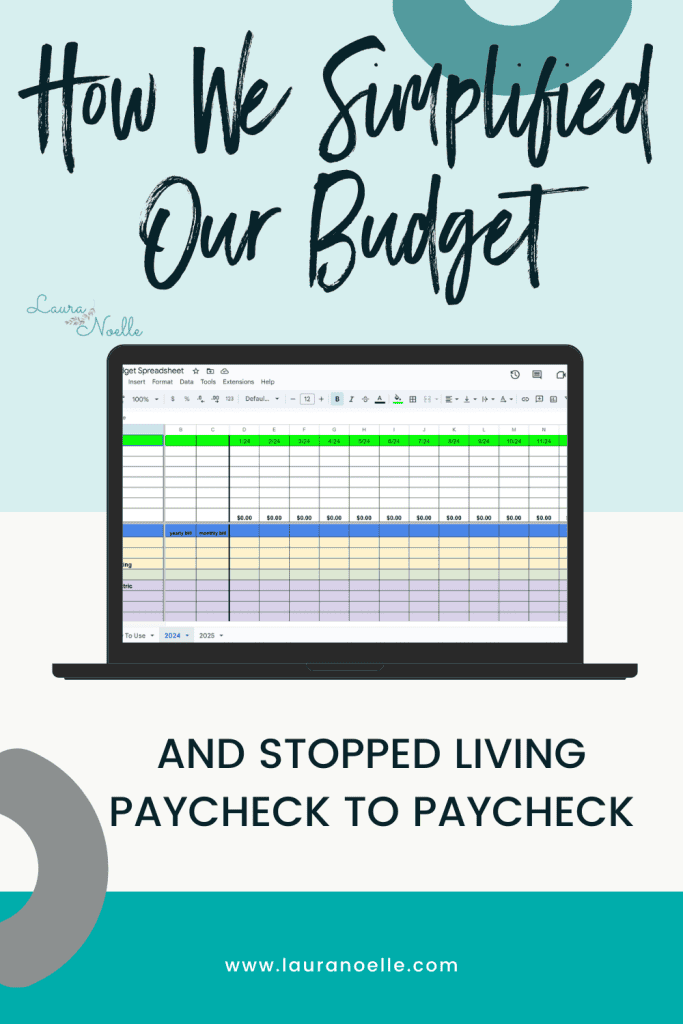

How We Simplified Our Finances & Stopped Living Paycheck to Paycheck

This post may contain affiliate links, which means I may receive compensation if you make a purchase using one of these links.

We’ve lived paycheck to paycheck for years. It was a constant source of anxiety that I couldn’t shake. I was the nerd who made the budget and balanced accounts, and seeing those numbers in the red was defeating, and left a bleak view of the future for our family.

A few years ago my husband and I decided enough was enough and we were going to get out of debt, pay off the car loan, and make a change. Of course, deciding you’ve had enough is just the first step. Doing it is much harder.

A bare-bones budget, lots of overtime, and selling a lot of stuff around the house got us out of debt, but then we were faced with growing an emergency fund and breaking the paycheck-to-paycheck cycle. But only a few months into that journey, my husband got laid off when his company shut down and we were left feeling completely lost yet again.

Faced with months of no work and finally a new job that was a 40% pay cut, I knew we had to change from the inside out to make this work.

Here’s what we did.

Simplify the Budget

When I say “simplify” the budget, I really mean strip it down to the membranes. As a family we sat down and decided we would sacrifice our subscriptions to Disney+, Minecraft realms, AAA membership, and Google One online storage, among others.

We had already spent years not eating out, cutting our own hair, no cable tv, and saving water and electricity. We had to go above and beyond to cut out every single thing not absolutely needed right now.

In order to stop living paycheck to paycheck, you have to create breathing room–a buffer–between your living expenses and your income. The regular bills and expenses must be less than the income, with a padding for unexpected expenses and an emergency fund for those rainy days.

I wanted to create as much of a buffer as possible, so I took some of our money we were putting into savings and got us started on the “month ahead” system. This works so that all the money we make in the current month is placed into a “paycheck holding” fund in the bank, and then on the 1st of the next month, the entire month’s budget is “funded” with the previous month’s paychecks.

Going a month ahead has given me so much peace about paydays that I use to stress about constantly. It doesn’t matter when the money comes now, because it won’t be touched until the next month. I still track our accounts daily to monitor for fraud and keeping within the budget, but I cannot overstate how amazing it feels to be ahead.

We use this Simplified Budget Spreadsheet I made to track our monthly income and create each month’s budget.

Qube It Up

I love the envelope system. I always have. And I love the idea of cash envelopes. But while I could make food and some fun money work with cash, it was tiresome to go back and forth to the bank to deposit and withdraw cash all the time.

When I found Qube Money, I was hooked immediately. Ya’ll. This has been a huge game-changer in our home. Simply put, it’s digital envelopes linked to a secure debit card that has some amazing features to prevent fraud and keep you accountable in your spending.

When I want to buy something, either online or at a store, I have to open the Qube app on my phone and tap the envelope I want to spend from to “open” it. When I do this, I have to look at the balance and know exactly how much is available to spend in that fund. When it’s gone, it’s gone. Only one transaction can go through each time it’s opened so you’re protected from fraud.

We have the Family plan, so my husband and I each have our own cards and logins, but our app interface is integrated. We also manage accounts and debit cards for our kids so that they can learn about responsible spending and saving.

You can try Qube money for free here.

Savings Saves the Day

We love Qube a lot, but we do still have one brick-and-mortar checking account and an online high-yield savings account. Qube is still adding new features and may replace those eventually, but for now we diversify between the three banks and it works well.

Having a fully funded emergency fund that could carry you through 3-6 months of expenses is key. We have painstakingly been building our fund up because things happen. Job loss, illness, natural disasters, car problems… All those things can cause so much stress if you have to put it on the credit card. (Speaking of credit cards–we paid those off and don’t use them anymore).

We lived that reality for years and now that we have some savings I can tell you it lifts that daily weight off your shoulders. We may be living on the tightest budget we ever have, but knowing that we are staying out of debt and thriving on our small income is worth its weight in gold. Even if you start with a few dollars, take on a side hustle, babysit or dog walk, have a garage sale–do whatever you can to start putting money in the bank. You’ll be so thankful you did.

Stop the Paycheck Insecurity

Living paycheck to paycheck is incredibly stressful, but you can stop the madness by creating an incredibly simple budget–so simple you have to stick with it! Add to the simple budget, a way to keep yourself accountable in spending, whether that’s cash envelopes, a notebook, or a digital system like Qube. Throw in getting ahead of those paychecks with the month ahead method and a nice padded emergency savings account, and you have a recipe to finally breathe a little deeper. Finances are tough, but you have the power to make them simple again!

Want to Save How We Simplified Our Finances & Stopped Living Paycheck to Paycheck for Later? Pin to your favorite Pinterest board here: